Saturday, Oct 25, 2025 | 02 Jumada Al-Awwal 1447

Saturday, Oct 25, 2025 | 02 Jumada Al-Awwal 1447

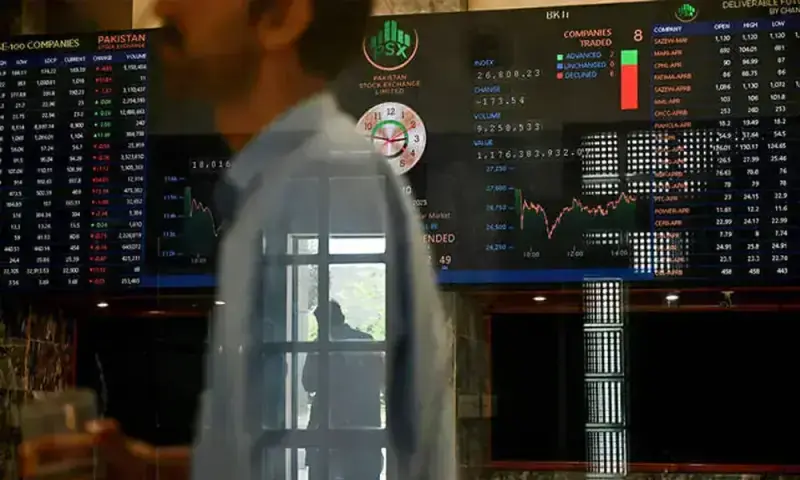

A day after heavy selling, bulls returned to the Pakistan Stock Exchange (PSX) as investor sentiments improved amid signs of easing geopolitical tensions and reduced political noise, with the benchmark KSE-100 Index gaining over 4,500 points during the intra-day trading on Tuesday.

At 11:10am, the benchmark KSE-100 Index was hovering at 163,025.64 , an increase of 4,582.22 points or 2.89%.

Across-the-board buying interest was observed in key sectors, including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation, and refinery. Index-heavy stocks, including HUBCO, ARL, MARI, OGDC, POL, PPL, PSO, SSGC, SNGPL, and WAFI, traded in the green.

“Sentiment remains the same. There was a huge sell-off from mutual funds yesterday,” Saad Hanif, Head of Research at Ismail Iqbal Securities, told Business Recorder.

He said that the buying comes amid “reduced political noise”.

On Monday, the PSX witnessed a sharp downturn as widespread profit-taking and weak investor sentiment dragged all major indices deep into negative territory. The benchmark KSE-100 Index fell by 4,654.77 points, or 2.85%, to close at 158,443.42 points.

Internationally, Asian stocks stumbled on Tuesday, as signs the US and China were preparing for trade talks later this month were tempered by uncertainty over whether the two nations could strike a durable deal.

Early gains for MSCI’s broadest index of Asia-Pacific shares outside Japan and the S&P 500 futures petered out to trade flat. Markets had earlier joined the rebound from Monday’s cash session after US Treasury Secretary Scott Bessent said US President Donald Trump remains on track to meet Chinese leader Xi Jinping in South Korea in late October.

Wall Street’s main indexes ended as much as 2.2% higher overnight, led by chipmakers, after Trump struck a more conciliatory tone on trade tensions with China.

Global equities had abruptly turned red on Friday after Trump announced 100% tariffs on China, reviving memories of the market volatility after April’s “Liberation Day” announcement.

The selloff only halted after the US president cooled his rhetoric on his Truth Social network.

After early gains in Hong Kong, the Hang Seng Index fell 0.4%, while in the mainland, the CSI 300 gauge of blue-chip Chinese stocks slipped 0.1%.

This is an intra-day update