Wednesday, Jul 23, 2025 | 27 Muharram 1447

Wednesday, Jul 23, 2025 | 27 Muharram 1447

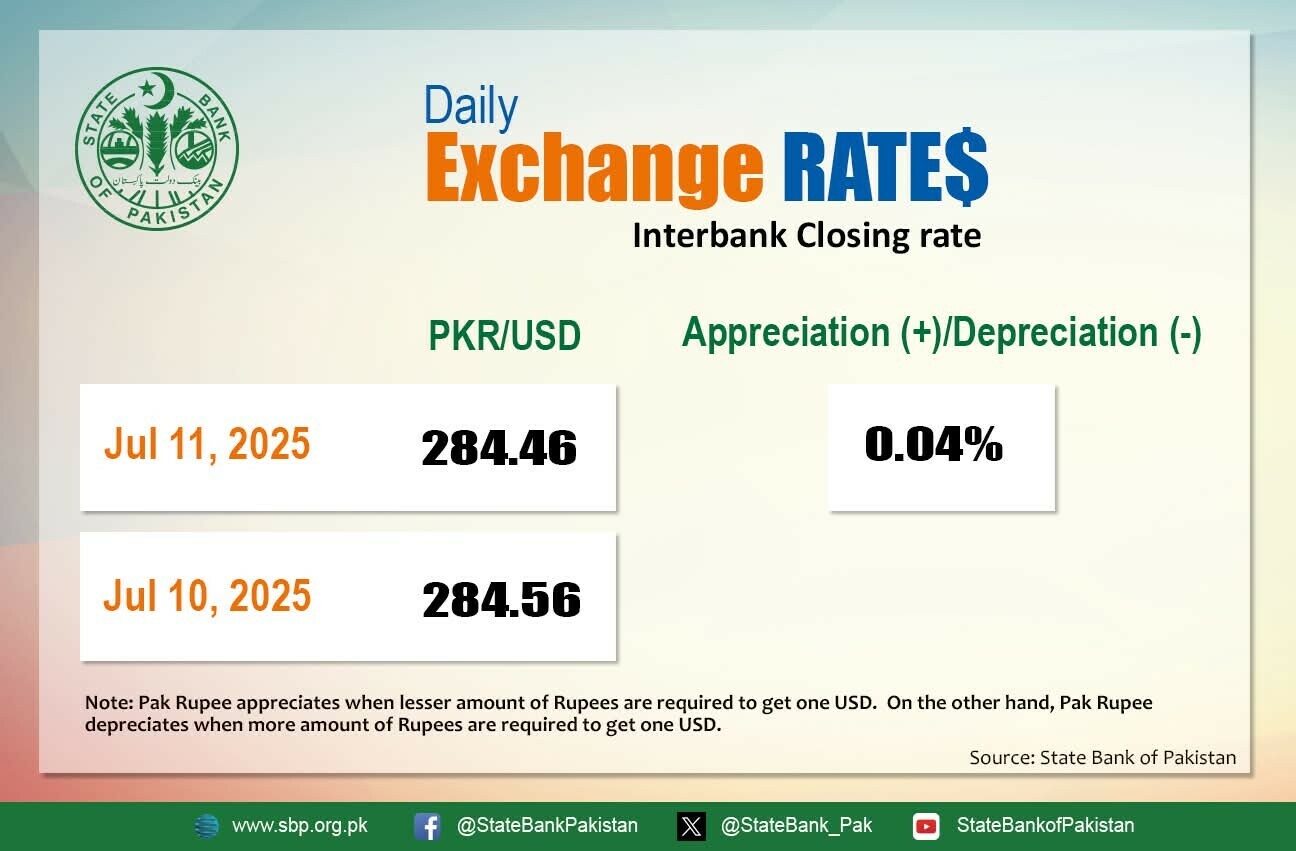

Pakistani rupee slightly improved against the US dollar, appreciating 0.04% in the inter-bank market on Friday.

At close, the currency settled at 284.46, a gain of Re0.10.

On Thursday, the currency settled at 284.56.

Internationally, the US dollar rose on Friday on more signs of upheaval in the global trade landscape, as US President Donald Trump announced more tariffs and said he planned to impose blanket levies of 15% or 20% on most trade partners.

Most currencies initially held to tight ranges early in the Asian trading session, though the dollar later gained ground on the back of Trump’s latest comments, which added to the uncertainty around his evolving trade policy.

The Canadian dollar was among the biggest losers, falling more than 0.5% to 1.3726 per US dollar after Trump announced a 35% tariff rate for goods imported from Canada, starting August 1.

Trump on Thursday also said the European Union could receive a letter on tariff rates by Friday, throwing into question the progress of trade talks between Washington and the bloc.

The euro fell 0.25% to $1.1671 and was headed for a weekly decline of nearly 1%.

The risk-sensitive Australian dollar also slipped 0.31% to $0.6568 as the overall market mood turned sour.

Oil prices, a key indicator of currency parity, rose by around 1% on Friday as investors weighed a tight prompt market against a potential large surplus this year forecast by the IEA, while U.S. tariffs and possible further sanctions on Russia were also in focus.

Brent crude futures were up 76 cents, or 1.11%, at $69.40 a barrel as of 1153 GMT. U.S. West Texas Intermediate crude ticked up 82 cents, or 1.23%, to $67.39 a barrel.

At those levels, Brent was headed for a 1.6% gain on the week, while WTI was up around 0.6% from last week’s close.

Inter-bank market rates for dollar on Friday

BID Rs 284.46

OFFER Rs 284.65

Open-market movement

In the open market, the PKR lost 5 paise for buying and remained unchanged for selling against USD, closing at 286.35 and 287.50, respectively.

Against Euro, the PKR gained 57 paise for buying and 30 paise for selling, closing at 335.68 and 338.65, respectively.

Against UAE Dirham, the PKR lost 9 paise for buying and 14 paise for selling, closing at 78.21 and 78.91, respectively.

Against Saudi Riyal, the PKR lost 1 paisa for buying and gained 2 paise for selling, closing at 76.43 and 76.98, respectively.

Open-market rates for dollar on Friday

BID Rs 286.35

OFFER Rs 287.50