Saturday, Oct 25, 2025 | 02 Jumada Al-Awwal 1447

Saturday, Oct 25, 2025 | 02 Jumada Al-Awwal 1447

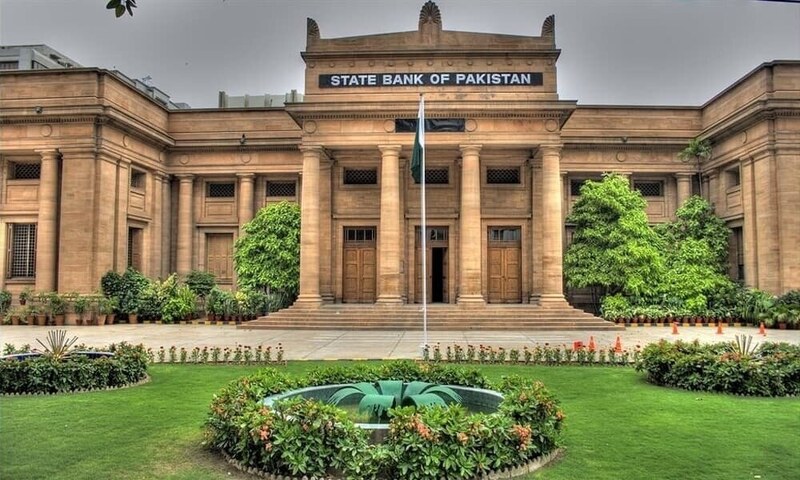

KARACHI: Senior representatives from the State Bank of Pakistan (SBP) and commercial banks have underscored the need for deeper collaboration between regulators, banks, and technology partners to accelerate Islamic and digital banking transformation in Pakistan.

Speaking at “NextGen Islamic Banking in Pakistan – 2025,” an exclusive forum hosted by TMC Pvt. Ltd. and Azentio Software in Karachi, they called for steps enabling financial institutions across Pakistan to modernize their operations, meet evolving regulatory requirements, and accelerate their Islamic banking transformation.

“Pakistan’s banking future depends on how well we integrate innovation, compliance, and inclusivity. The State Bank’s Vision 2025 aims to shape a financial ecosystem that is Shariah-compliant, digitally empowered, and accessible to all segments of society. By fostering partnerships between regulators, financial institutions, and technology providers, we can achieve a resilient and future-ready banking sector,” said Dr. Zahid ur Rehman Khokher, Director Islamic Finance Policy Department, State Bank of Pakistan.

Industry leaders from Islamic Banking and Sharia Compliance discussed success stories and a roadmap for building a modern, compliant, and innovation-driven banking ecosystem.

Haroon Tabraze, Principal Advisor, Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) emphasized the importance of standardization and capacity building in ensuring Pakistan’s banking sector remains aligned with global Shariah practices.

Rizwan Ata, President and CEO, BankIslami Pakistan Ltd, highlighted strategic challenges and practical solutions in implementing large-scale Shariah-compliant models, by presenting BankIslami case study. Ahmed Ali Siddiqui, Group Head & SEVP – Consumer Finance, Meezan Bank Limited, shared insights on Meezan Bank’s experience of conversion from Conventional to Islamic Banking.

Copyright Business Recorder, 2025