Friday, Dec 12, 2025 | 20 Jumada Al-Akhirah 1447

Friday, Dec 12, 2025 | 20 Jumada Al-Akhirah 1447

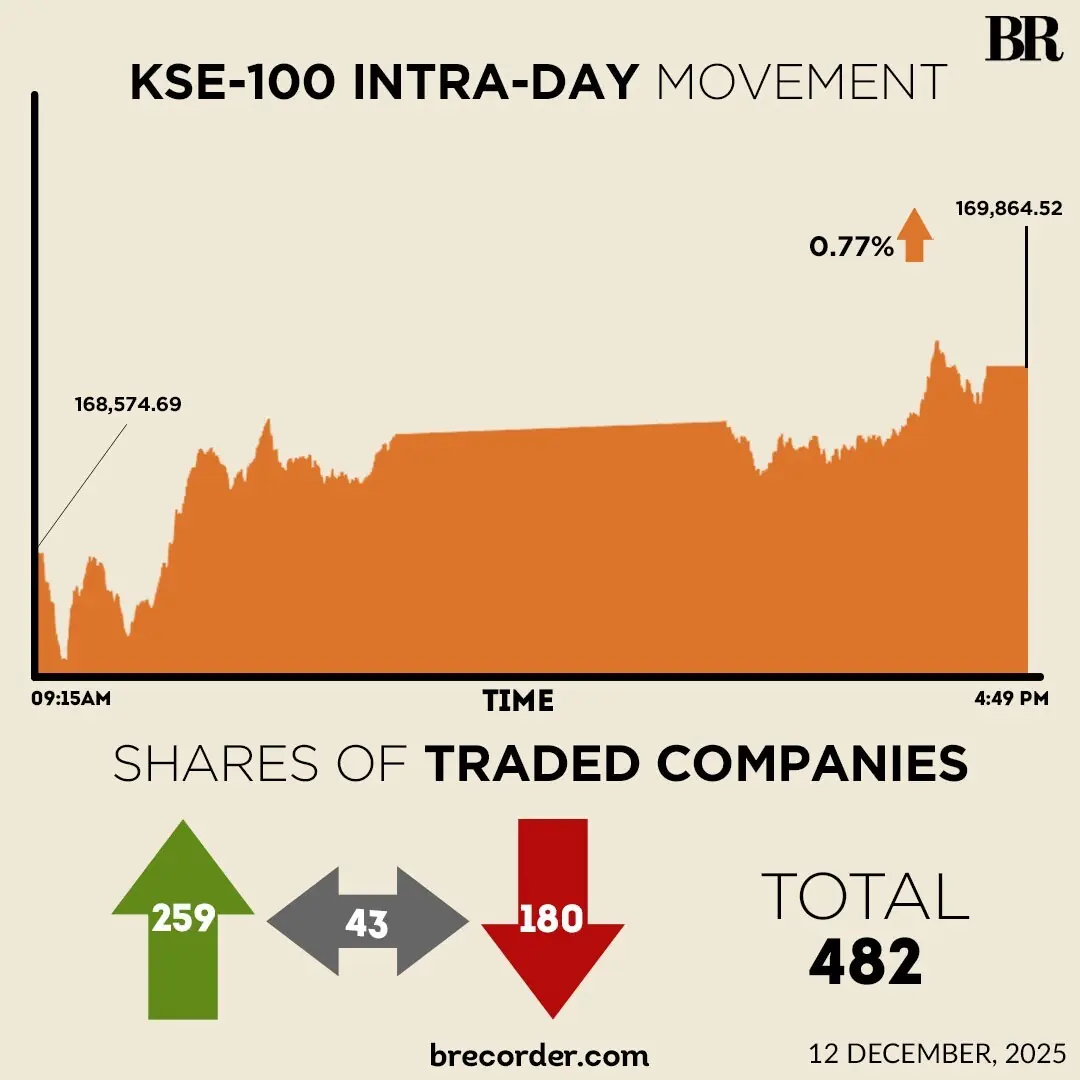

Sentiment at the Pakistan Stock Exchange (PSX) remained positive on Friday, with the benchmark KSE-100 Index ending the week’s last session up by nearly 1,300 points.

Buying momentum was observed throughout the trading session, pushing the KSE-100 to an intra-day high of 170,052.87.

At close, the benchmark index settled at 169,864.52, an increase of 1,289.83 points or 0.77%.

Top positive contribution to the index came from FFC, MCB, SYS, MLCF, PPL, EFERT and HUBC, as they cumulatively contributed 962 points to the index, brokerage house Topline Securities said in its post-market report.

On Thursday, PSX witnessed a mixed session with major indices closing predominantly lower amid cautious investor sentiment as investors engaged in profit-taking and cautious trading amid uncertainty over market direction. The KSE-100 Index fell by 877.17 points, or 0.52%, to close at 168,574.69 points.

KSE 100 Index gained 1.66% on week-on-week basis.

“This gain can be accredited to news that IMF board on Monday approved a $1.3 billion loan by granting waivers for missing a few core conditions and landmark Rs659.6bn power sector debt settlement,” Topline said.

On the economic front, the International Monetary Fund (IMF) slapped 11 new structural benchmarks (SBs) on Pakistan, including developing and publishing a comprehensive medium-term (3 to 5 years) tax reform strategy, asset declarations of high-level federal civil servants and an action plan to mitigate corruption vulnerabilities in identified departments.

Meanwhile, Pakistan’s central bank is expected to retain interest rates at 11% on Monday as analysts push back rate-cut forecasts to late 2026 after the IMF warned inflation risks persist and policy must stay “appropriately tight”.

Globally, Asian stocks advanced in early trade on Friday following strength on Wall Street overnight, though a fresh decline in Oracle’s share price sent jitters through the tech sector.

Financial markets had to move fast to find their footing this week when the Federal Reserve cut interest rates but gave a less hawkish outlook than expected, and the return of AI bubble worries added to the stress for investors.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.7%, tracking mostly higher US markets on Thursday - the Dow and Russell 2000 indices hit new highs, but the Nasdaq fell.

Tokyo’s Nikkei 225 outperformed the region in morning trade, climbing 1% as shares in Softbank Group surged 6% after Bloomberg News reported it is considering acquiring the US data centre company Switch Inc.

S&P 500 e-mini futures were unchanged, and Nasdaq futures were down 0.2% as markets were on edge after Oracle shares plunged 13%, sparking a tech selloff, as the company’s massive spending and weak forecasts fanned doubts over how quickly the big bets on AI will pay off.

Meanwhile, the Pakistani rupee recorded marginal improvement, appreciating 0.01% against the US dollar in the inter-bank market on Friday. At close, the local currency settled at 280.32, a gain of Re0.04 against the greenback.

Volume on the all-share index decreased to 873.03 million from 1,288.97 million recorded in the previous close. The value of shares declined to Rs40.87 billion from Rs55.23 billion in the previous session.

Hum Network was the volume leader with 71.84 million shares, followed by Dost Steels Ltd with 46.97 million shares, and WorldCall Telecom with 40.81 million shares.

Shares of 482 companies were traded on Friday, of which 259 registered an increase, 180 recorded a fall, and 43 remained unchanged.