Wednesday, Dec 17, 2025 | 25 Jumada Al-Akhirah 1447

Wednesday, Dec 17, 2025 | 25 Jumada Al-Akhirah 1447

After much dilly-dallying, the government has finally made a move on net metering regulations.

The latest set of regulations draftsought for approval by the power regulator are nothing short of seismic. Expect uproar, from parliament to the opinion pages. But this was coming, is much needed, and is just about the right thing to do. Regular readers would recall this space advocating rationalization in net metering regulations ever since the solar rush gathered pace.

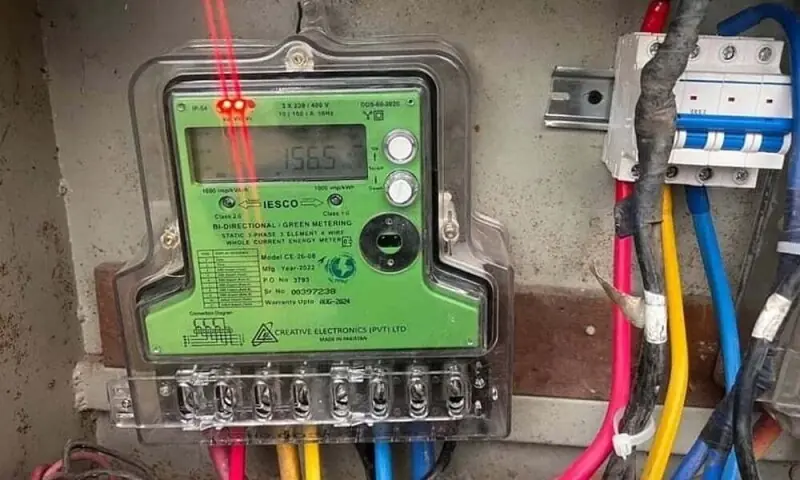

The National Electric Power Regulatory Authority (Prosumer) Regulations, 2025 set the agreement term to five years, down from seven years in the previous set of regulations. The allowance beyond sanctioned load reportedly led to distribution network bottlenecks, as reverse power flows increased transformer burnouts, particularly in high solar concentration zones.

A key amendment has been made to the allowed capacity of the generation facility at the prosumers’ end. From 1.5 times the sanctioned load, it has been reduced to not more than the sanctioned load. It may sound small, but it is anything but.

Reduced power factors and voltage fluctuations at peak generation hours added to the technical issues, caused partly by allowing oversized capacity beyond sanctioned load. With new additions allowed at not beyond the sanctioned load, reverse power flow related load problems stand to go down, although not eradicated, as no less than 6 GW of net metered capacity is still out there, exceeding the sanctioned load on respective transformers.

And then there are changes in the billing mechanism, and that will perhaps invite the most criticism in the days to come. The ministry had hinted at addressing the anomalies in no uncertain terms before being shot down by the Prime Minister twice, so it does not come as a surprise, strictly speaking. What does come as a surprise is that they have decided to opt for both rationalization measures, one related to the buyback rate and the other related to the treatment of import and export units.

The buyback rate is now proposed to be reduced substantially from the National Average Power Purchase Price (NAPPP) to the National Average Energy Purchase Price (NAEPP). This is as big as it gets. Recall that back in 2023, Nepra conducted a hearing for the same but ended up against amending it, citing economic benefits of net metering in terms of displacement of costlier electricity, savings of foreign exchange, and incurring minimal losses. The marginal price of electricity generation for FY26 is close to Rs9 per unit, as against the NAPPP of close to Rs24 per unit. The payback period for new solar prosumers is set to increase significantly.

And then there is the small matter of going from net metering to net billing. Under the net billing mechanism, units consumed from the grid are not adjusted against solar generation during the day, and solar consumers are instead billed separately for units imported and exported. This means much improved and more equitable pricing, and reduced strain on discos’ financials.

It must be remembered that the regulations, if they sail through, will apply only to new connections, and not to the already installed capacity of around 6 GW. The measures are sure to elongate payback periods to levels seen in countries where solar adoption is at advanced stages. It must not be forgotten that the bulk of the solar rise is happening behind the meter or off grid, and the net metering regulation amendments are not meant to be a hindrance. It is expected that battery solutions and self-consumption will both increase as a result.

Interesting times are ahead to gauge how consumers react to this new set of much needed regulations. There will be hue and cry, but overall, the right thing has been done, and kudos to the authorities for doing so.