Monday, Feb 09, 2026 | 20 Shaban 1447

Monday, Feb 09, 2026 | 20 Shaban 1447

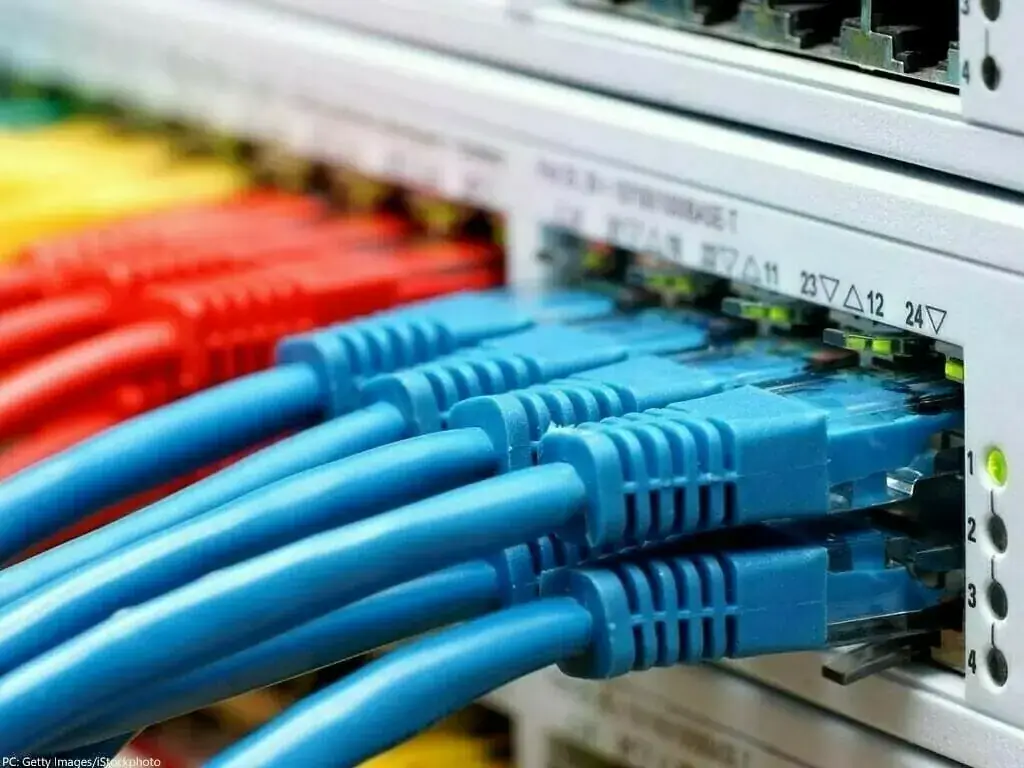

ISLAMABAD: Directorate General of Customs Valuation Karachi has reduced customs values on the import of networking equipment including fibre broadband Wi-Fi routers.

In this regard, the directorate has issued valuation ruling 2040 of 2026 on Thursday.

Through the new ruling, the directorate has revised Customs values on the import of networking equipment for assessment of duty and taxes.

According to the ruling, the Directorate General of Customs Valuation Karachi received representation to review the values of WIFI routers. Earlier Valuation Ruling of 2024 was issued based on the decision of Appellate Tribunal vide judgment dated May 16, 2023 and subsequent orders passed by the DG Valuation, Karachi to re-visit the values accordingly.

READ MORE: New customs values fixed for USBs, memory cards

Therefore, keeping in view the above and in pursuance of analysis, of import data, current market trends, the difference in market prices and customs values, an exercise for the determination of customs values of subject goods was initiated under Section 25 and 25A of the Customs Act, 1969.

A meeting was conducted to deliberate in detail upon the issues relating to the valuation of the subject goods.

During the meeting, the importers contended that the existing valuation ruling reflects values on the higher side when examined in the light of prevailing international prices. They asserted that their declared transaction values are genuine, competitive and based on actual commercial invoices, and further submitted that the current market conditions do not support the continuation of the existing determined values.

In support they submitted commercial invoices and relevant documents.

The viewpoints of the stakeholders were analyzed, and a detailed examination of import data for the preceding ninety (90) days was conducted, in conjunction with a review of the documentary evidence submitted by the importers, including commercial invoices, packing lists, and other relevant import documents.

Furthermore, a comprehensive market inquiry was carried out to ascertain prevailing prices and trade practices, which was examined in the light of this Directorate’s Office Order and in terms of Section 25(7) of the Customs Act, 1969, so as to ensure that the determination of customs values is based on objective criteria, current market conditions, and verifiable data.

Finally, on the basis of a comprehensive evaluation of import data, market enquiry findings, and international price trends, the Customs values of the subject goods were determined, the ruling added.

Copyright Business Recorder, 2026